Volver

2 junio 2023

Servitisation for a green transition: The journey ahead for circular business model financing

Third EaaS Consortiums' International Virtual Dialog

Servitisation for a green transition - The journey ahead for circular business model financing

On May 16th 2023, the EaaS Consortium held its third international virtual dialog which explored the challenges and opportunities of financing circular business models with experts and stakeholders already implementing the model.

XaaS – Unlocking additional value for all stakeholders involved.

- Christian Levie of Econocom and Dirk Verbruggen of CFO Center Belgium highlighted the advantages of the as-a-service model, such as value creation, improved customer relationships, market expansion, flexibility, and ecological benefits. The speakers also mentioned the potential benefits for financial institutions, including new business opportunities, recurring revenue, partnerships, and contributions to sustainability.

- Dirk further stated that the CFO of a firm must play a key role in finding solutions for various issues, such as off-balance construction and operational leasing. While funding can be obtained through a mix of equity leasing, loans, and crowdfunding for as a service models.

- The speakers emphasized the importance of addressing knowledge gaps and considering financing and product lifecycle management from the start, as well as having suitable IT systems and management capacity to successfully scale EaaS operations and be appealing to investors. Overall, the speakers underlined the value and importance of improved risk assessment, consensus, transparency.

- To conclude the speakers mentioned that financial institutions should expand financing solutions, collaborate with impact financiers, and prioritize governance and monitoring for long-term projects. Financing criteria should include supplier commitment, risk identification, and management, while communication, quality business cases, training, and collaboration help overcome obstacles on decision making. The speakers also mentioned that different leasing structures and invoicing arrangements exist based on market preferences which solution providers can benefit from.

Scaling Light as a Service (LaaS)

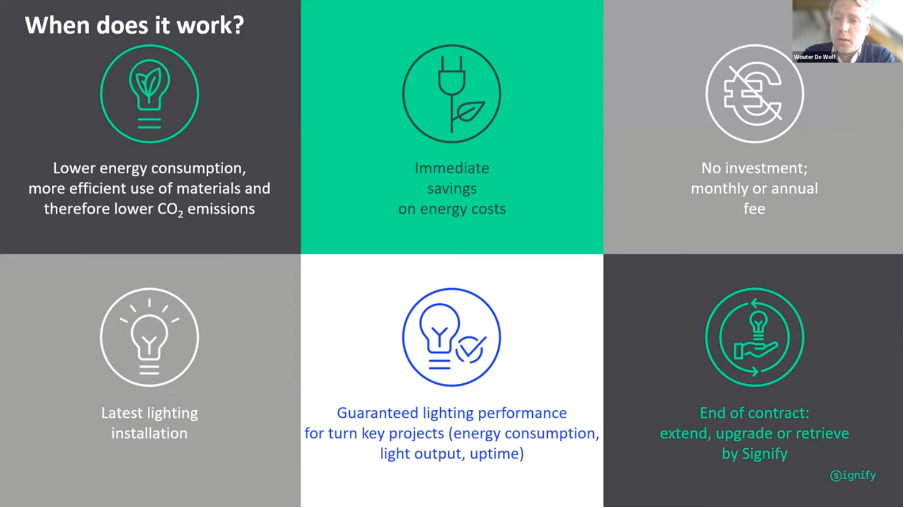

- In this section, Wouter de Wolf elaborated on Signify’s approach to light as a service, offering hassle-free planning, designing, installation, operation, maintenance, and optimization of lighting solutions to customers.

- Wouter further highlighed the importance of proper documentation, credit requests, equity, and not relying solely on loans for financing EaaS projects. He also emphasized the value of quality and considering the future lifecycle of assets.

- The importance of including performance indicators such as energy usage, light levels, and uptime in their service were furthermore underlined by Wouter, while also highlighting the need to collaborate with financial partners for financing projects. Last but not least, Wouter emphasized the benefits of lower energy consumption, reduced carbon footprint, and circular economy principles through LaaS which are brought forward in an accelerate pace to customers.

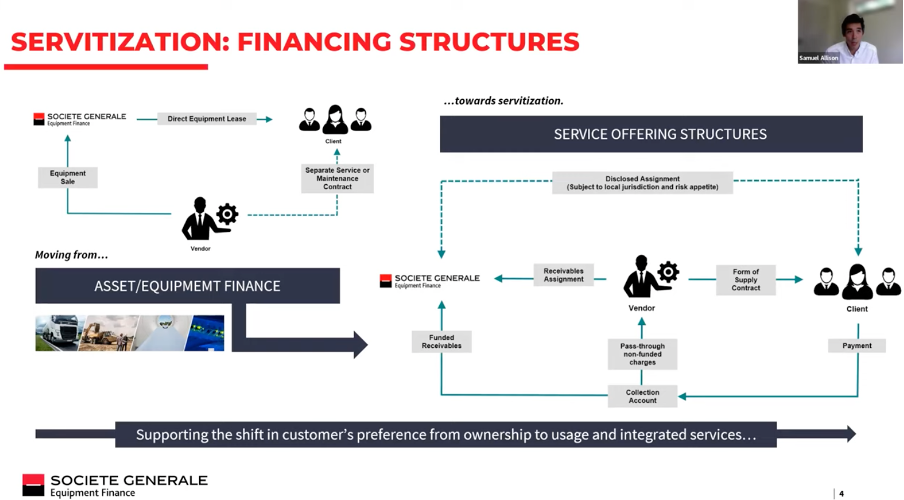

Highlighting the key difference between EaaS and an embedded lease

- Samuel Allison of Société General Equipment Finance (SGEF) started by sharing the different areas of action of SGEF to scale impact in decarbonisation solutions, Sam highlighted the growing interest of the bank in the healthcare and green energy sectors due to the positive impact from an economical, social and environment perspective, while also being in alignment with EU sustainability criteria.

- Samuel clarified the key differentiation between embedded lease contracts (where Société General has extensive experience) and real “EaaS” contracts, for which Sam highlighted the link between asset finance, servitization, and circularity, emphasizing the ecological benefits and incentives for stakeholders involved.

- Samuel mentioned key considerations to embed into an EaaS offering – such as pricing models and accounting impacts. He highlighted that advanced services contracts and usage-based models are becoming increasingly prevalent, providing additional revenue opportunities for service providers and impact on markets.

- Samuel took the opportunity to share a recent example onto which Société General financed a solar as a service (or PPA) contract where the ownership of the equipment is with the solution provider while the customer pays a fee per consumption.

Recording and Q&As

The webinar can be viewed on the EaaS project Youtube Channel

The presentations are available here and the Q&A can be found here.

The speakers

- Christian Levie, Deputy Managing Director of Econocom Lease – Econocom Belux. Christian is executive board member of the Belgian Lease Association and has a career of over 30 years in financing and leasing. Econocom supports companies and governments in the implementation of as-a-service business models, product-service combinations, leasing solutions.

- Dirk Verbruggen, Regional Director and part time CFO – CFO Center Belgium. Dirk is an experienced senior-level executive with an extensive experience in Finance and Sustainability as well as in multinational environments (Toyota Material Handling BE&FR) as in SMEs. Dirk is active in sustainable finance and specialised in Circular Economy/Finance-Funding with state of the art new Circular business models and financing methods.

- Wouter De Wolf, Marketing Manager B2B – Signify. Wouter has worked at the intersection of innovation, sustainability and B2B marketing for more than 15 years. In various positions at Berenschot, Philips and Signify, he has always loved developing and marketing new, sustainable B2B propositions.

- Samuel Allison, International Program Manager – Societe Generale Equipment Finance. Samuel Allison holds Asset Finance Industry experience spanning 13 years, of which 10 years have been with Societe Generale Equipment Finance across a number of different roles. His current responsibility lies in the overall management and coordination of Global Finance Programs for Partners spanning the Green Energy and Healthcare markets, where demands for financial products that go beyond equipment leases or embedded leases have opened up new opportunities and ways of working.